In financial services messaging a delayed communication can mean a lost customer or worse, a security breach.

Today’s customers expect instant, secure, and personalized interactions. But too many banks, lenders, and fintechs still rely only on passive, impersonal and less urgent methods like email or voice mails, which not only frustrate users but also expose the organization to operational risk. That’s where real-time smart messaging comes in.

Whether it’s a critical fraud alert, sending an OTP (one time password) or a timely loan status update, the ability to reach customers in the moment on the channels they trust can make the difference between a great customer experience and a churned account.

Let’s take a closer look at two high-impact financial services messaging use cases that your organization should have in place.

High Impact Financial Services Messaging Use Case #1: Suspicious Activity Alerts

When a customer’s account is compromised, every second matters. Delayed fraud alerts can lead to unauthorized transactions, financial loss, and long-term damage to trust. And from a business perspective, failing to act quickly on suspicious activity can trigger regulatory scrutiny and chargeback costs.

Messaging allows you to intercept fraud attempts in real time.

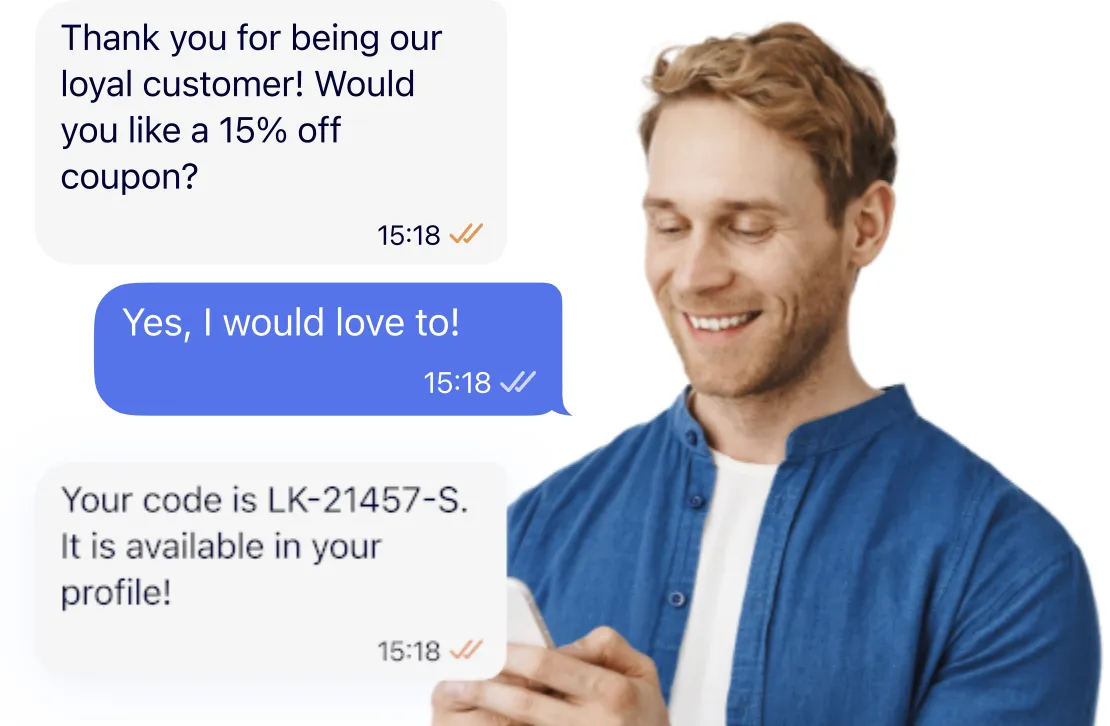

Imagine this: A customer receives a message instantly after an unusual transaction is detected

“We noticed a $215.80 charge at Electronics World. Was this you?”

[Yes] [No]

If they hit No, the system can automatically freeze the card, initiate a follow-up verification, and trigger a fraud investigation, without a single phone call.

This is more than a convenience. It’s a safety net. And it works across a wide range of security scenarios:

- Unrecognized login attempts

- Password reset requests

- Location-based access alerts

- Card activation or freeze confirmations

- Two-factor authentication prompts

Messaging for financial services does more than improves the customer experience. It strengthens your fraud prevention capabilities with faster, more scalable, and auditable communications.

High Impact Financial Services Messaging Use Case #2: Loan in Progress – from Application to Approval

Loan applications are high-stakes, high-friction moments for customers. Every delay, unanswered question, or missing document adds friction—and increases the risk that a customer will abandon the process or look elsewhere.

With messaging, you can proactively guide applicants through the process, reducing uncertainty and drop-off.

Here’s how that could look in action:

“Your car loan application is under review. Want us to notify you when the status changes?”

[Yes, send updates] [No thanks]

That single message opens a channel for ongoing updates:

- Missing document requests: “We still need proof of income.”

- Approval notification: “Congratulations! Your loan has been approved.”

- Disbursement info: “Funds will be deposited within 2 business days.”

- Repayment schedule reminders: “Your first payment is due June 1st.”

Instead of waiting for customers to check their inbox or pick up the phone, messaging brings the loan process to them—in real time, on their preferred device.

The result? Faster decisions, fewer abandoned applications, and happier borrowers.

Why Messaging Is the Missing Link in Financial Services CX

Customers today don’t just expect digital convenience – they demand real-time relevance. Messaging for financial services meets that demand by making every touchpoint faster, more personal, and more effective.

From reducing fraud to accelerating revenue, messaging helps financial institutions:

- Mitigate risk with proactive security communications

- Improve compliance with timely policy and document alerts

- Increase satisfaction by reducing support volume and delays

- Drive conversions through personalized, event-triggered offers

- Build loyalty through smoother onboarding and support

And with channels like SMS, WhatsApp, RCS, Telegram, and Viber, you can reach customers wherever they are, without requiring them to download another app or wait on hold.

Want More Financial Services Messaging Ideas?

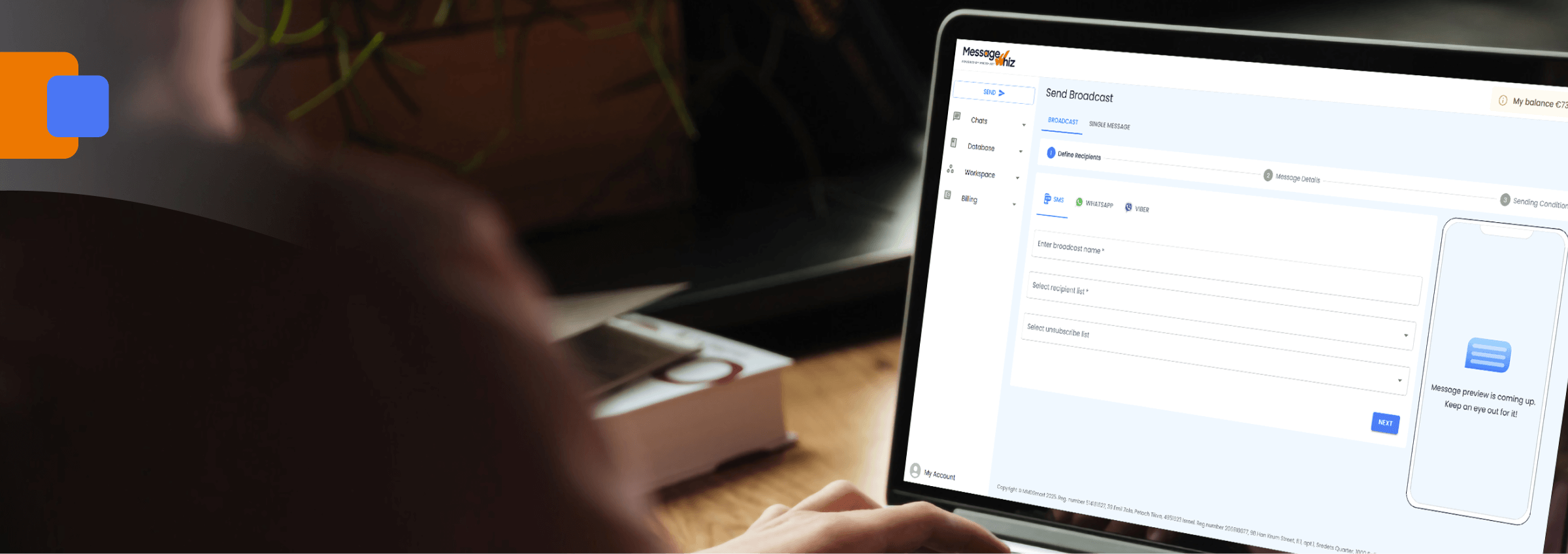

We’ve put together a full guide with 10 ready-to-deploy high impact messaging use cases, whether you are leveraging SMS, WhatsApp, RCS, Viber, Telegram or other channels for financial services messaging — from account setup and KYC to payment reminders and post-service feedback. Learn how to turn messaging into a competitive advantage—securely, seamlessly, and at scale. Download it today!

Secure Omnichannel Communications for Financial Services

In today’s financial world, trust, timing, and security are everything. That’s why MessageWhiz helps banks, fintechs, and trading platforms deliver secure, real-time communications that convert. Whether you’re looking to grow revenues, improve security, or optimize campaign performance, MessageWhiz is built for financial services.