Securing Customer Account Communications

Account security is one of the biggest challenges facing businesses today. This issue cuts across all verticals, including financial accounts, gaming accounts, and retail accounts. Once those accounts are compromised, cyber-criminals can use saved customer credit cards, clear out savings that may have taken a lifetime to amass, or change passwords and completely take over an account.

The bulk of the responsibility to secure these accounts ultimately lies with the customer. However, when accounts are taken over, it reflects poorly on the service provider and business owner. It behooves them to offer the tools needed to secure the account. Even if it is the customer who was manipulated by a phishing scam, most customers believe that it is their service provider’s responsibility to further secure their account.

According to the Cybersecurity & Infrastructure Security Agency (CISA), one of the most effective ways to secure accounts is through multifactor authentication (MFA). MFA is a layered approach to securing an online account. Customers must enter something that they know, such as a username and password, and supplement that with something that they have, such as a text with a one time password that was sent to their mobile device.

This blog looks at security and additional use cases for using one time passwords over SMS.

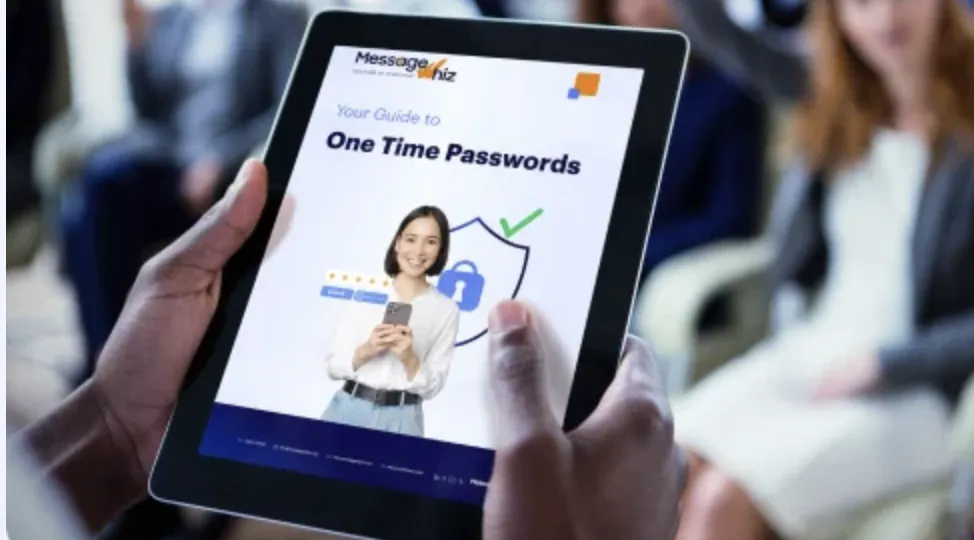

Download our One Time Password ebook and help secure your customers’ accounts!

One-Time Password Use Cases

In an era where digital fraud is on the rise, businesses must take proactive steps to safeguard customer accounts and sensitive transactions. OTPs provide a simple yet highly effective way to verify identity, ensuring only authorized users gain access to critical services.

Account Access – Protect Private Data

Unauthorized account access can lead to data breaches, identity theft, and financial loss. By requiring an OTP during login, businesses add an extra layer of security that prevents hackers from exploiting stolen credentials. Even if a password has been compromised, access is denied without the unique, time-sensitive OTP.

Messaging-based OTPs provide a seamless user experience while maintaining strong security. Whether logging into an online banking portal, a subscription service, or an enterprise communication platform, customers receive an instant verification code that confirms their identity, reducing unauthorized access attempts.

Activating Bank Cards or New Subscriptions – Protect Financial Tools with 2FA OTP

Financial institutions must ensure that only the rightful owner can activate a new bank card or subscription-based service. By sending an OTP via SMS or a secure messaging app, banks and service providers can confirm the user’s identity before activation, reducing fraud risks.

This method also builds trust with customers, who appreciate the added communication security for their financial tools. With a quick OTP confirmation, users can confidently activate their services while institutions mitigate risks associated with unauthorized activations.

Confirm High-Value Transactions – It Pays to Double Check

When large sums of money are at stake, an extra verification step is essential. OTPs provide a quick and effective way to confirm high-value transactions, ensuring that only the account holder can approve payments, wire transfers, or large purchases.

By requiring an OTP before processing these transactions, financial institutions and retailers add a crucial fraud prevention measure. Customers appreciate the added security, knowing that even if their credentials were compromised, their funds remain protected from unauthorized transfers.

One Time Passwords – Download this must-read ebook today and start securing customer accounts

Lost Password Retrieval – Ensure New Passwords Reach the Right People

Forgetting a password is common, but ensuring that only the rightful owner can reset it is critical. OTPs add a layer of verification to password resets, preventing cybercriminals from hijacking accounts through compromised email addresses or leaked credentials.

By sending an OTP to a verified phone number or messaging app, businesses can ensure that password reset requests are legitimate. This reduces the risk of unauthorized access and enhances customer confidence in digital security measures.

New Subscriber Verification – Make Sure Your New Subscribers Are Who They Claim to Be

Fake accounts and bots can distort subscriber data and pose security risks. Requiring new subscribers to verify their identity with an OTP ensures that only real users gain access to services, improving data accuracy and reducing fraudulent activity.

This verification step is especially important for businesses offering free trials, loyalty programs, or gated content. By implementing OTP-based verification, companies can maintain the integrity of their subscriber base while providing a secure and seamless onboarding experience.

Implement Strong Security Measures

Cyber threats are constantly evolving, and businesses must stay ahead by implementing strong, user-friendly security measures. One-time passwords (OTPs) offer a reliable, effective way to protect customer accounts from unauthorized access, fraud, and data breaches. Whether securing logins, verifying transactions, or preventing account takeovers, OTPs provide an essential layer of defense that balances security with convenience.

Want to reduce fraud and secure customer accounts? Get expert insights and proven OTP strategies—download our free ebook now! Give your customers the protection they expect while safeguarding your business from security threats.

![10 SMS Marketing Services Compared [2026 Guide] | Message Whiz blog image](https://messagewhiz.com/wp-content/uploads/2025/11/smiling-woman-holding-smartphone-remixed-media-2.jpg)