When we launched the 2026 State of Digital Customer Communication Survey, we had two key questions in mind.

How are companies actually using messaging, and what are the challenges that are shaping their decisions?

Omnichannel engagement, conversational messaging, personalization, and AI-driven optimization dominate industry conversations. But beyond vendor narratives and conference presentations, we wanted to capture the operational reality facing teams responsible for growth, customer experience, and engagement.

An independent third-party research firm conducted this study. They surveyed 300 senior leaders across financial services, hospitality, travel, gaming, and ecommerce. Participating organizations ranged from 50 to 1,000 employees, each generating at least $10M in annual revenue. These were companies operating at scale, balancing rising customer expectations with real-world system constraints.

The results revealed a consistent theme: strategic clarity paired with execution friction. Here are the key findings:

- 99% of surveyed leaders say omnichannel communication is strategically important.

- Only 43% of companies have expanded beyond email and SMS.

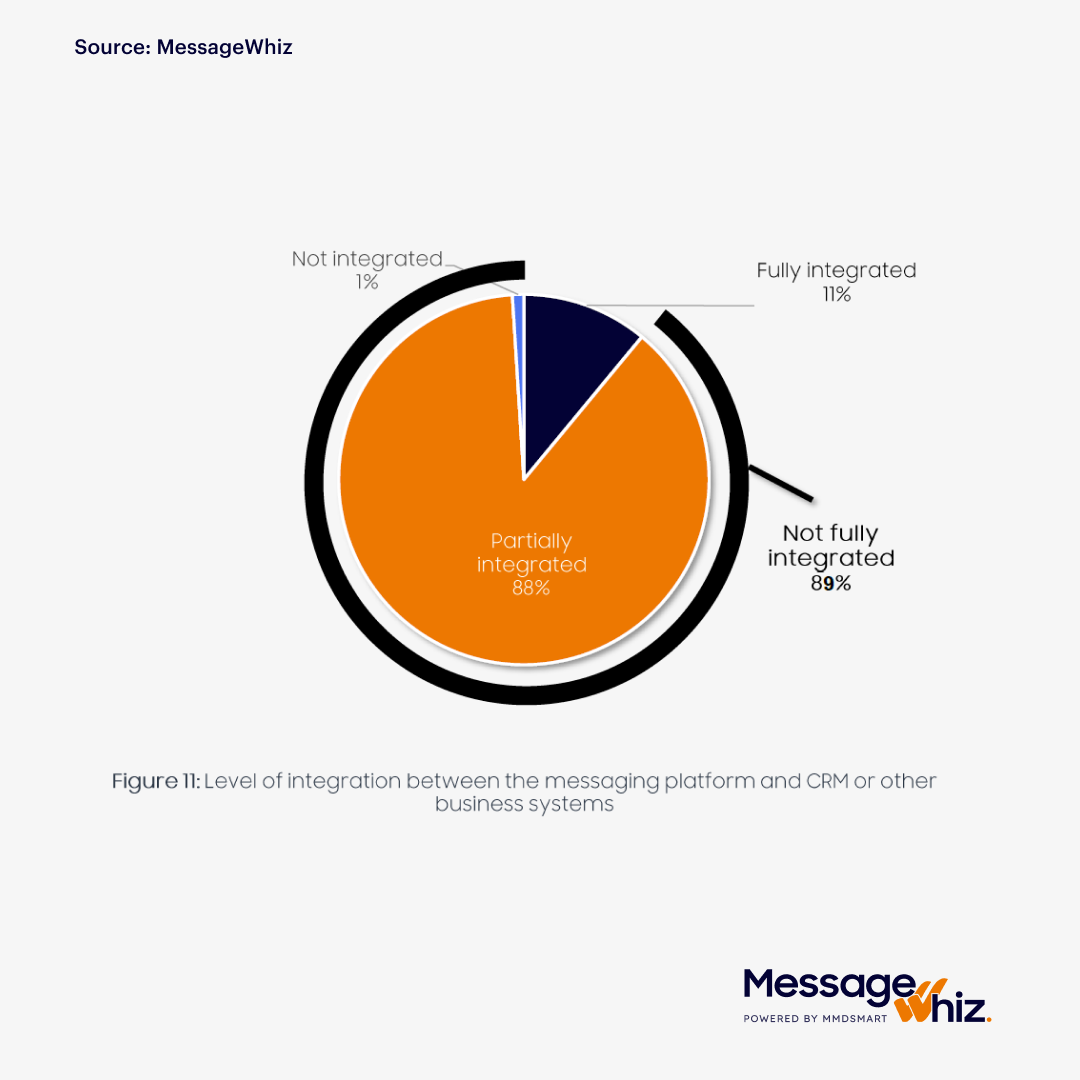

- Just 11% report full integration between messaging platforms and CRM/business systems.

- Messaging is used mostly for operations (support + notifications = 63%), not growth.

- The #1 blocker is fragmentation: multiple tools, partial CRM sync, and limited analytics/personalization.

- The opportunity in 2026: unify channels + integrate CRM + add real-time contextual decisioning to turn messaging into a revenue lever.

What “true omnichannel communication” means

Omnichannel communication is not “more channels.” It is connected communication where:

- The customer experience feels continuous across channels

- Context follows the customer (history, preferences, intent)

- Messaging responds to real-time events (behavioral and operational triggers)

- Channels are integrated with CRM and business systems so journeys can adapt dynamically

This is why adding more channels like WhatsApp, Viber, RCS, Telegram without orchestration often creates new silos, not better experiences.

Omnichannel Has Won the Strategic Debate, but the Operational Battle Is Ongoing

Omnichannel communication is no longer an emerging idea or an experimental strategy. For most organizations, it is already embedded in growth plans, customer experience initiatives, and digital transformation programs.

An extraordinary 99% of respondents described omnichannel as strategically important to their organization. Among C-level executives, 74% classified it as either very important or extremely important, placing omnichannel firmly in the “high importance” category.

The strategy conversation is settled. The execution conversation is not.

Despite widespread alignment, only 43% of surveyed companies have expanded beyond email and SMS. This gap is not simply about channel adoption; it reflects the complexity of delivering a truly connected experience.

Email and SMS remain essential. They are reliable, familiar, and deeply embedded in digital communication stacks. But they are increasingly baseline channels, not indicators of omnichannel maturity.

True omnichannel communication is defined not by how many channels a company uses, but by how seamlessly those channels work together. Conversations must feel continuous. Context must follow the customer. Messaging must respond dynamically to real-time events.

Most importantly, communication channels must be tightly integrated with systems like CRM.

Yet only 11% of respondents reported full integration between their messaging platforms and CRM or business systems.

Without orchestration, expanding a channel mix often creates new silos rather than eliminating old ones. Customers experience this as inconsistency: disconnected conversations, repetitive outreach, and fragmented journeys.

Messaging is Operationally Critical, but Strategically Underleveraged for Growth

One of the survey’s most revealing insights was how organizations currently position messaging within their business.

Messaging is everywhere, but its role remains heavily skewed toward operations.

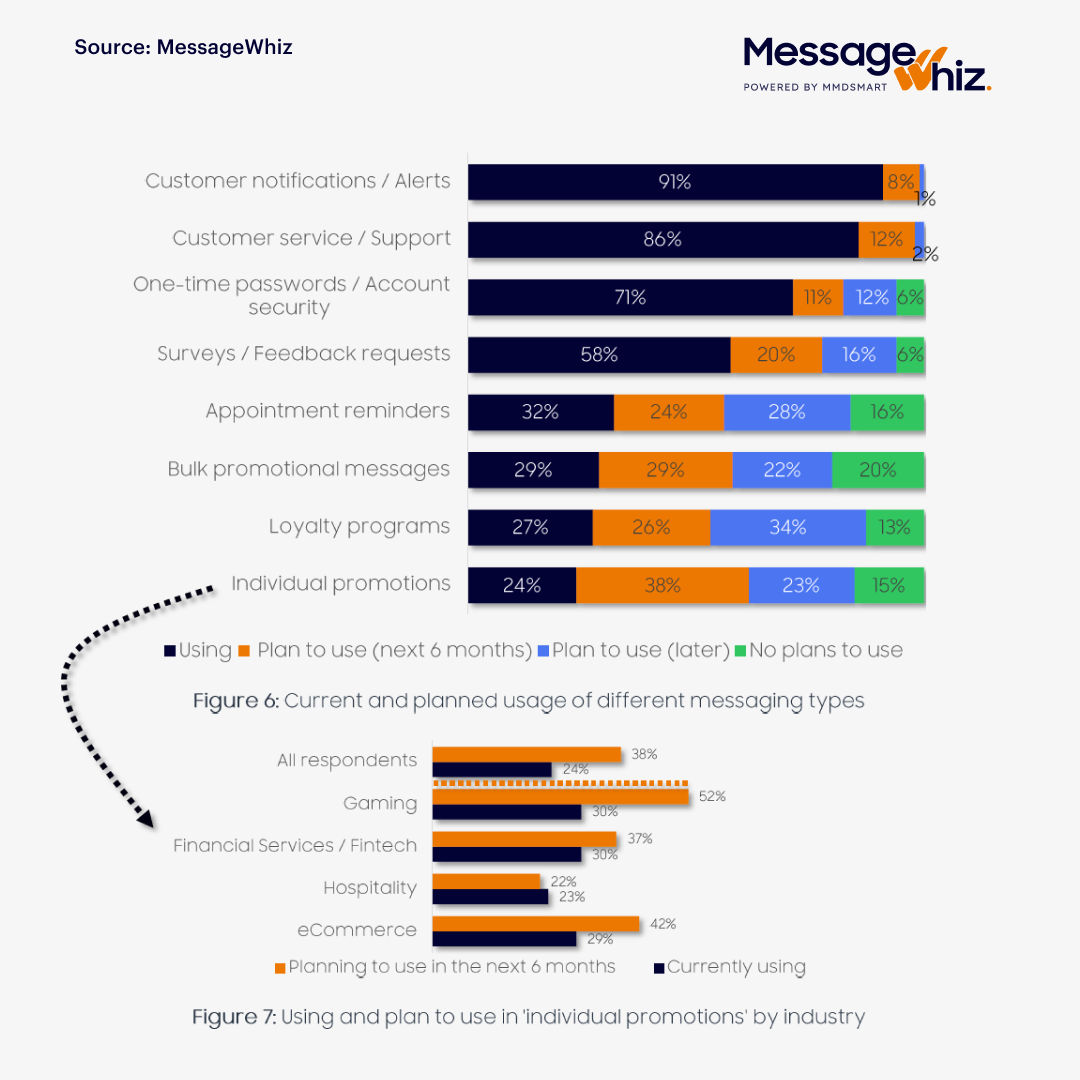

33% of respondents cited customer support as their primary messaging use case,

30% pointed to operational notifications.

Together, these categories represent 63% of messaging focus.

By contrast;

26% primarily use messaging for marketing or promotions

11% focus on retention or loyalty initiatives.

At a broader level, the imbalance becomes even clearer:

99% of organizations use messaging for operational purposes

53% use it for growth or revenue-generating activities.

Operational messaging is indispensable. Alerts, OTPs, service updates, and support interactions are foundational to customer trust and business continuity. But when messaging is viewed primarily as a utility layer, its ability to drive engagement, conversions, and lifetime value remains underdeveloped.

The good news is that this mindset is changing.

Across industries, the number of survey respondents planning to expand growth-focused messaging activities within the next six months more than doubled.

Usage of individual promotional messaging is projected to increase by 158%

Loyalty messaging is expected to grow by 96%.

Messaging is evolving from operational necessity toward revenue strategy.

Fragmentation Remains the Primary Barrier to Progress

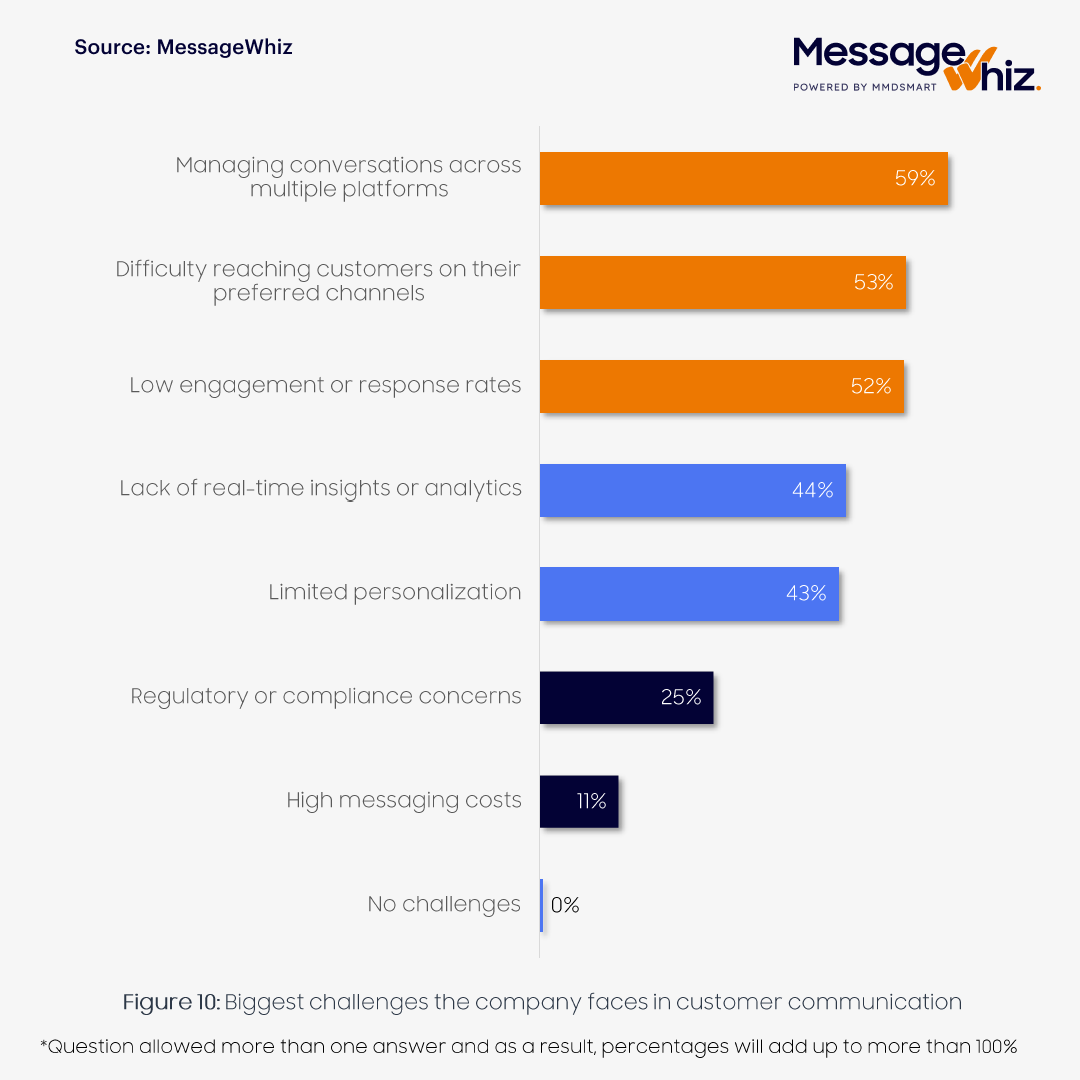

Across the survey, the biggest challenges all point to the same root cause: disconnected systems.

Top pain points:

- 59% struggle to manage conversations across multiple platforms.

- 53% have difficulty reaching customers on preferred channels.

- 44% lack real-time insights or analytics.

- 43% cannot execute effective personalization.

Nowhere is this more visible than in CRM integration. A striking 89% of respondents reported having only partial or no integration between their CRM and messaging platforms.

Without real-time synchronization between customer data and messaging activity:

- Journeys cannot adapt dynamically

- Personalization becomes limited

- Performance measurement loses critical business context.

- Messaging becomes reactive rather than intelligent, disconnected rather than orchestrated.

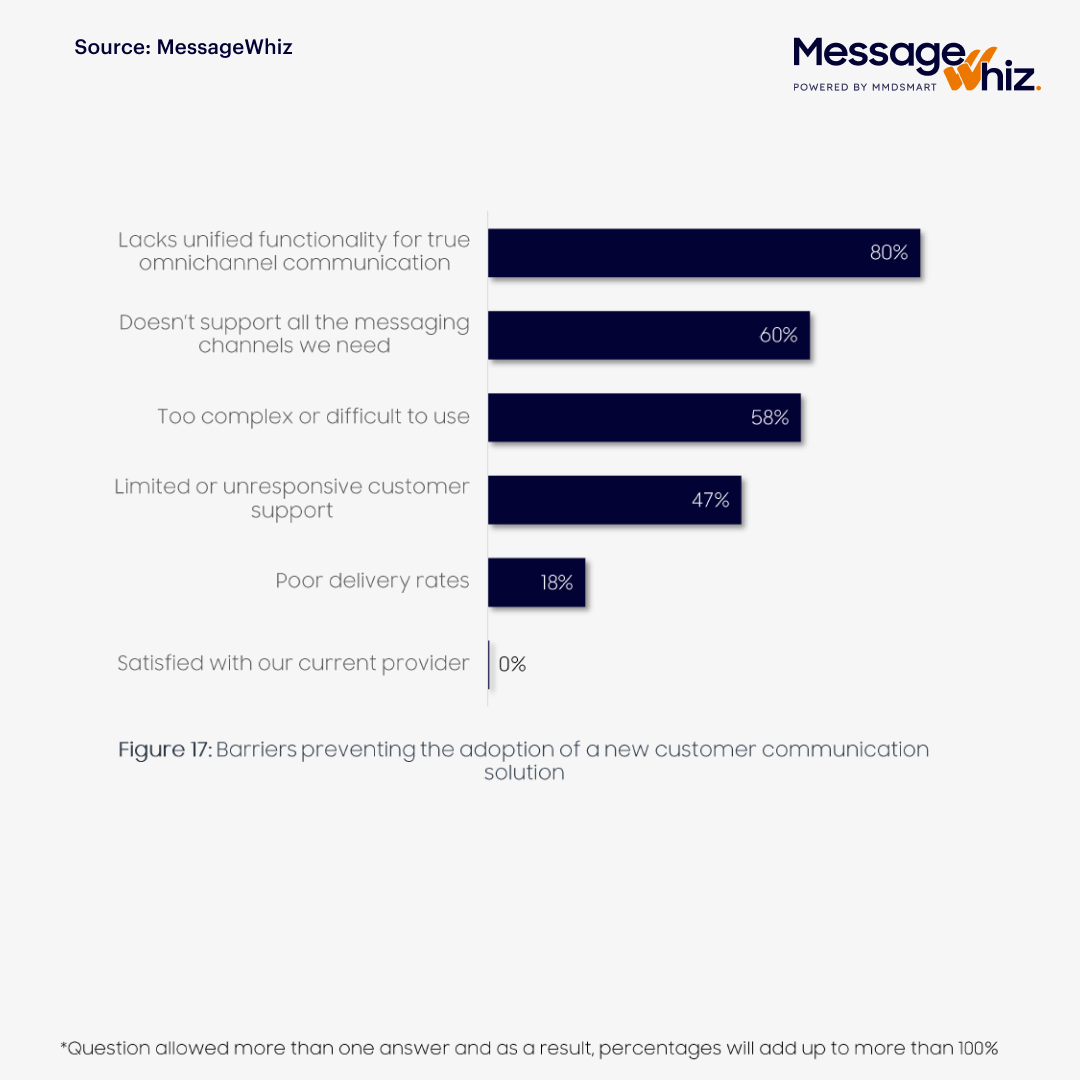

There is absolutely no surprise that when asked about barriers to adopting new communication solutions, 80% cited lack of unified functionality for true omnichannel communication.

Companies are not simply searching for more channels. They are searching for cohesion.

Beyond the Headlines

While headline statistics capture attention, the full 2026 State of Digital Customer Communication Survey Report explores a far richer landscape, including how organizations evaluate AI in communication decisions, what messaging success actually means to executives, regional differences in channel priorities, and investment outlooks.

For teams navigating channel expansion, stack consolidation, or messaging-driven growth strategies, the findings reveal both cautionary patterns and clear opportunities.

Download the MMDSmart MessageWhiz 2026 State of Digital Customer Communication Survey.

![10 SMS Marketing Services Compared [2026 Guide] | Message Whiz blog image](https://messagewhiz.com/wp-content/uploads/2025/11/smiling-woman-holding-smartphone-remixed-media-2.jpg)