Financial services are changing quickly as we run up to 2026. Customers expect instant answers, regulators are paying closer attention, and fraudsters are getting smarter. Even for small and medium businesses that deliver lending, payments, fintech, forex, and crypto services, messaging is no longer just a way to send reminders. It is how you protect your business, keep customers engaged, and stay compliant.

Below we explore the top financial services messaging trends for 2026 and how both small and larger players can take advantage of them.

AI Enters Everyday Financial Services Messaging

Artificial intelligence is no longer futuristic. Banks and fintechs are now deploying AI-driven tools to handle simple customer interactions. That means a loan applicant can check their approval status with a single text, or a trader can ask for real-time currency quotes directly through WhatsApp.

No matter what the size of your company, you must focus on making communication with your customers more convenient and helpful. Even an automated SMS reminder about upcoming payments, or a WhatsApp flow that confirms transaction status, can deliver big-bank convenience.

Why it matters: Deloitte’s 2025 Banking and Capital Markets Outlook highlights AI adoption as one of the top drivers of customer experience transformation.

Real-Time Messaging for Real-Time Finance

The rise of instant payments and embedded finance means customers expect to know what is happening as it happens. Whether it is a loan approval, a crypto wallet balance update, or a forex trade reaching a threshold, clients want confirmation immediately.

This is where global messaging delivers real value. Real-time alerts reduce inbound support calls and increase customer trust. They also drive faster decisions. A borrower who receives instant approval is more likely to finalize the loan. A trader who gets a rate alert in real time is more likely to take action.

Why it matters: McKinsey’s 2025 Global Payments Report notes that real-time and embedded finance are among the fastest-growing segments in the financial sector.

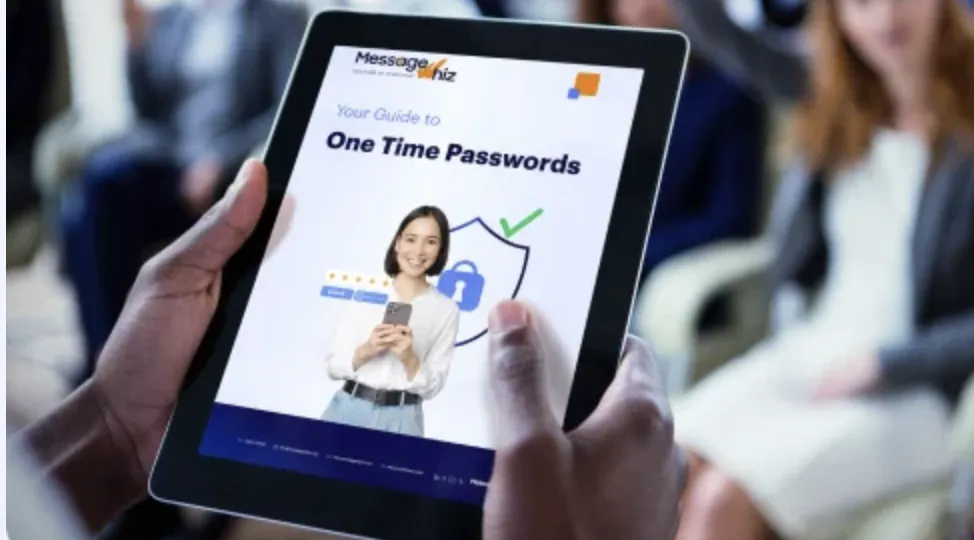

Messaging and Security Go Hand in Hand

The same channels that help you reach customers are also exploited by fraudsters. Fake loan offers, phishing texts, and crypto scams are common and damaging. Customers will only trust your business if your official messages are secure and recognizable.

Practical steps include:

- Using verified sender IDs to prevent spoofing

- Sending one-time passwords or confirmation codes for high-risk actions

- Educating customers on what your legitimate messages look like

- Offering a clear channel to report suspicious messages

These are not enterprise-only practices. Affordable messaging providers like MessageWhiz now include verification and compliance features suited to all budgets.

Why it matters: Verizon’s 2025 Data Breach Investigations Report found that more than 90 percent of breaches start with social engineering attempts such as phishing.

Get started with messaging. Download our ebook with 10 use cases for financial services providers.

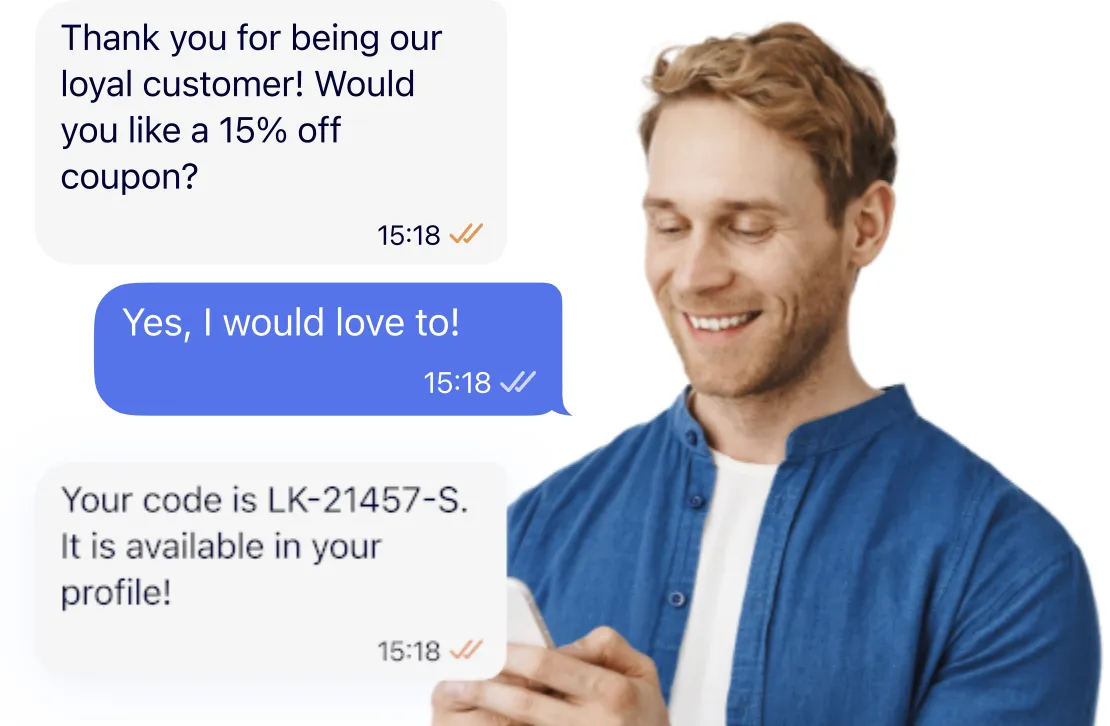

Personalization Without Overload

Customers want financial services communication that is relevant and useful, not generic. A well-timed reminder about a loan repayment, an alert when a crypto wallet balance dips, or an offer tailored to an existing service builds loyalty.

But personalization can cross the line. Too many messages, or offers that feel invasive, cause opt-outs and distrust. The key is balance: deliver value, keep messages concise, and respect customer preferences.

Why it matters: Accenture’s 2025 Global Banking Consumer Study found that 72 percent of customers welcome personalized messages when they save time or money.

Efficiency and Inclusion Matter Too

Messaging is cost-effective compared to many marketing and service channels, but costs add up as volume grows. Your company should keep messages efficient by using lightweight formats, fallback channels like SMS, and clear, concise content. You should also look for easy to use apps that do not require too many resources to manage efficiently.

Inclusion is also critical. Not every customer has a smartphone or consistent internet access. By ensuring that basic SMS messages work alongside richer formats, you can expand your reach and avoid leaving segments behind.

Why it matters: GSMA’s 2025 Mobile Economy report found that more than 40 percent of the global population still relies on basic mobile services, underscoring the importance of simple, inclusive messaging.

Personal Support Becomes Part of the Package

As messaging becomes the backbone of financial services, providers are moving beyond offering just technology. More messaging platforms now include hands-on support to help firms maximize value. Instead of leaving businesses to figure it out on their own, providers are stepping in with onboarding guidance, compliance advice, and campaign optimization.

This deeper level of service is especially valuable for small and medium financial firms that lack large IT or operations teams. Some providers, like MessageWhiz, even assign dedicated account managers available 24×7 to ensure customers always have expert help when they need it.

Why it matters: Many SMBs hesitate to adopt new platforms because of limited resources. Support that goes beyond ticket-based troubleshooting lowers the barrier to entry and helps firms succeed with enterprise-grade messaging.

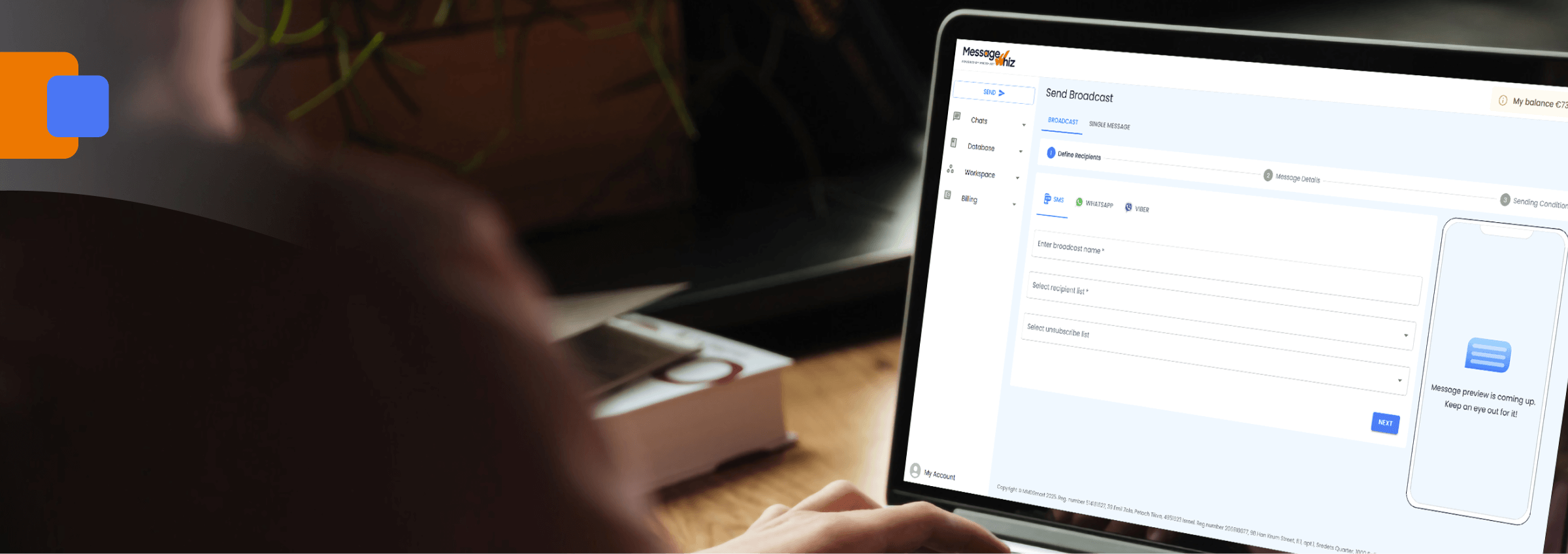

Easy and Flexible Integration Lowers Barriers

Integration challenges have long slowed down adoption of new communication tools in financial services. Connecting messaging platforms to CRMs, payment systems, or trading platforms traditionally required heavy IT involvement, long projects, and high costs. Today, that is changing. More providers are prioritizing flexibility with APIs, prebuilt connectors, and low-code options that let businesses integrate messaging quickly and at lower cost.

This shift is especially important for small and medium financial firms that need to move fast without dedicating large teams or budgets. Affordable providers, including MessageWhiz, now make it possible to plug messaging into existing workflows in days rather than months, so firms can start sending secure, real-time messages immediately and scale as needs grow.

Why it matters: Easy integration reduces time to value, minimizes IT overhead, and allows financial services companies of all sizes to adopt modern messaging without being slowed down by technical hurdles.

Takeaway for 2026

For financial services firms, messaging in 2026 is about more than staying in touch. It is about trust, speed, and compliance. The businesses that get it right will give their customers the confidence of a big-bank experience, without needing big-bank budgets.

The good news is that the tools are available now. By focusing on secure, real-time, and personalized communication, companies of all sizes that deliver lending, payments, fintech, forex, and crypto services can thrive in this new environment.

MessageWhiz gives you a unified messaging platform to easily communicate with customers wherever they want, wherever they are. With AI-powered tools, an intuitive interface, and a proven 99 percent delivery rate, MessageWhiz messaging for financial services firms makes it simple for your firm to deliver big results.

Next Step: Learn from Real Use Cases

Want to see how other financial businesses are already putting messaging to work? Download our Financial Services Use Cases Ebook for practical examples you can apply right away.

![10 SMS Marketing Services Compared [2026 Guide] | Message Whiz blog image](https://messagewhiz.com/wp-content/uploads/2025/11/smiling-woman-holding-smartphone-remixed-media-2.jpg)