Fintechs, crypto exchanges, and other financial innovators have mastered the technology behind modern money movement. Their platforms are fast, intelligent, and built to scale. But while they excel at financial services, many are still catching up when it comes to communication.

Customers expect instant answers, complete transparency, and a human touch even when automation is in play. For fast-moving financial services companies, meeting those expectations is no small task. One unclear message can shake trust, slow growth, or trigger compliance risk.

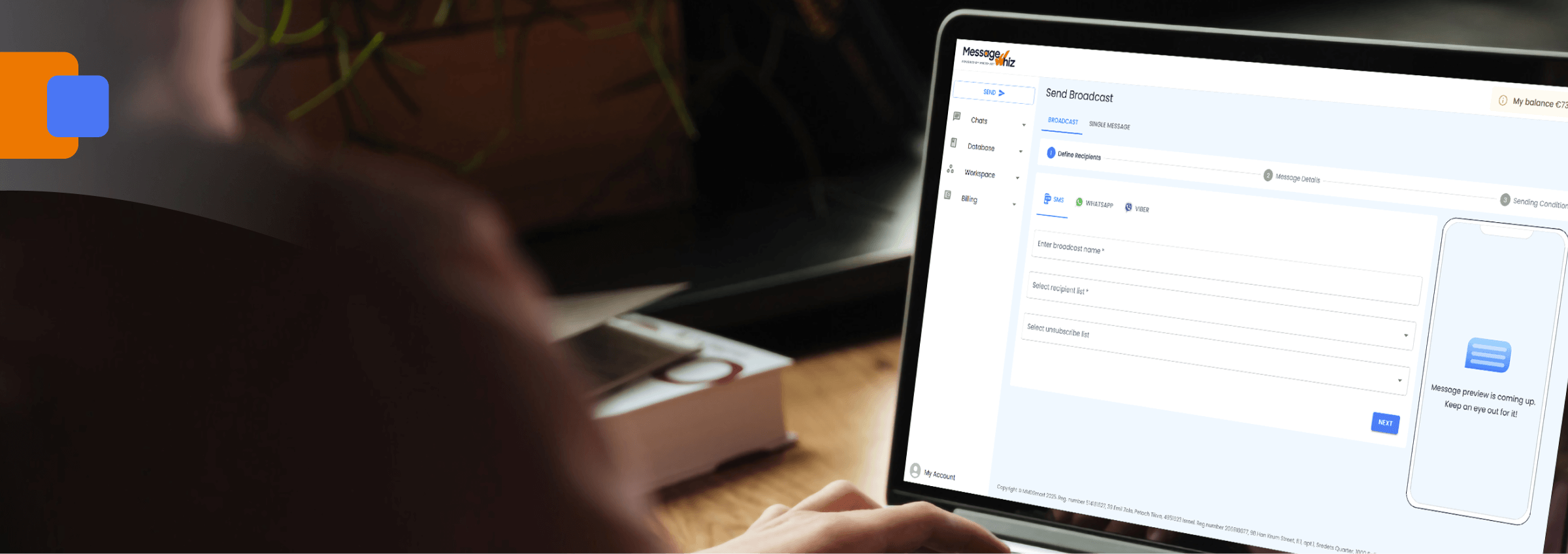

That is where MessageWhiz comes in. By unifying communication across every channel and automating critical customer interactions, MessageWhiz helps fintechs, exchanges, and payment innovators deliver the clarity and confidence their customers expect.

What Are the Key Communication Challenges Facing Financial Services Companies?

The typical financial services customer expects communications to be as easy as moving money around the world. They expect real-time confirmations, instant support, and security at every step.

This creates a need for constant communication. Support tickets pile up. Customers get vague or delayed updates. Teams struggle to stay consistent across SMS, email, WhatsApp, chat, and voice.

MessageWhiz is built to fix exactly that.

Where Does MessageWhiz Deliver the Biggest Wins for Financial Services Communication Challenges?

A modern messaging platform can eliminate many of the most frustrating communication gaps. Below are the key areas where MessageWhiz makes an immediate difference.

High Volume and Fast Scale

When your customer base grows, your messaging platforms needs to scale with it. Delays or unanswered requests are not an option when people are waiting for transaction confirmations or KYC results.

How MessageWhiz helps:

- Automated notifications for common actions like transfers, deposits, and verifications

- Instant OTPs and communication for urgent issues such as account lockouts or suspected fraud

- Real-time alerts across SMS, WhatsApp, RCS, email, and voice

Result: Customers get the speed they expect, and your support team stays in control.

Consistent Omnichannel Experience

Customers often begin a conversation in one channel and continue in another. Without unified messaging, those interactions feel disjointed and repetitive.

How MessageWhiz helps:

- Brings all communication into one intuitive platform

- Keeps conversation history synchronized across channels

- Ensures consistent tone, language, and compliance wording

Result: Customers never have to repeat themselves, and your brand sounds the same everywhere.

Refunds, Disputes, and Account Holds

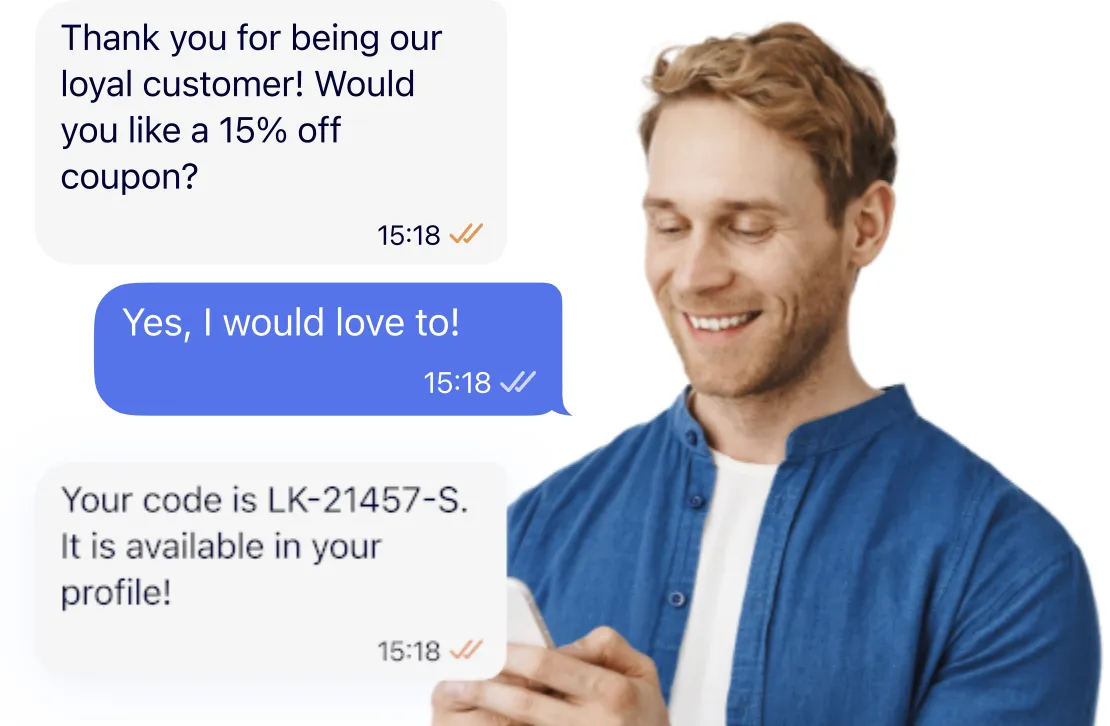

Few moments cause more stress than when money is delayed or an account is frozen. Clear, timely communication is essential to maintaining trust.

How MessageWhiz helps:

- Sends automatic updates about refund or dispute status

- Explains what is happening and what to expect next in simple language

- Supports secure two-way replies so customers can confirm actions

Result: Transparency reduces panic, and customers feel informed instead of ignored.

Outages, Incidents, and Crisis Management

Even the strongest platforms experience downtime or unexpected issues. The difference between damage and recovery often comes down to how you communicate.

How MessageWhiz helps:

- Sends real-time alerts to affected customers through verified channels

- Uses pre-approved templates for fast, accurate updates

- Segments audiences so only relevant users receive notifications

Result: Clear, coordinated messaging that protects reputation and keeps users calm.

Product Education and Feature Adoption

Financial products are complex. Customers often need guidance to understand fees, transaction processes, or new features.

How MessageWhiz helps:

- Delivers personalized onboarding and product walkthroughs directly in chat

- Uses interactive prompts that guide customers step by step

- Sends proactive tips that explain features at the right time

Result: Fewer misunderstandings and higher engagement with new services.

Customer Feedback and Optimization

Great communication depends on feedback. MessageWhiz turns every conversation into measurable insight.

How MessageWhiz helps:

- Automatically triggers short satisfaction surveys after interactions

- Tracks response times, message delivery, and engagement rates

- Provides analytics that reveal weak spots in the customer journey

Result: Continuous improvement based on real customer data.

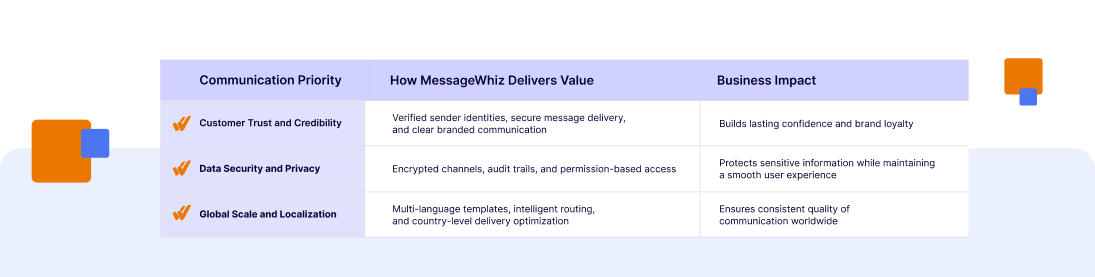

How MessageWhiz Strengthens Every Part of Financial Communication

MessageWhiz was built for the realities of modern financial services. Regulations shift, customers expect transparency, and security cannot wait. Our platform gives financial services teams the flexibility, control, and intelligence to communicate clearly and compliantly in every situation.

Every message sent through MessageWhiz reinforces trust and customer satisfaction. From a first-time deposit confirmation to a high-stakes transaction alert, our platform ensures that communication remains secure, consistent, and aligned with business goals.

Why Solving Financial Services Communication Challenges Matters Now?

The financial technology industry runs on trust and speed. Customers expect their funds, messages, and confirmations to move instantly. Every delay or vague response erodes confidence.

MessageWhiz gives fintechs, exchanges, and payment innovators the ability to communicate with precision, security, and clarity. Whether you are handling thousands of new signups, managing a global user base, or responding to an unexpected outage, MessageWhiz ensures your customers always feel informed and valued.

If you are ready to simplify communication and deliver the experience modern financial customers expect, it is time to connect with MessageWhiz.

Schedule a demo or download our latest Financial Services Use Case Guide to see how smarter messaging drives real results.